“See us here” in NYC in November!!!

Revolutionary Times in Auto Insurance Pricing

For years, auto insurers have used crude miles driven classification schemes in their premium calculations. The logic of crude schemes presumably lay in the difficulties of verification: Carriers didn’t want to spend money on audits and could not fully trust self-reports. This situation is in the process of changing drastically. Technological change opened the door to a revolution in pricing when consumer financial transaction data came on-line and insurance scores using credit information became widely available and cheap. But the coming revolution in miles-based pricing may have an even bigger impact than the credit scoring revolution.

For years, auto insurers have used crude miles driven classification schemes in their premium calculations. The logic of crude schemes presumably lay in the difficulties of verification: Carriers didn’t want to spend money on audits and could not fully trust self-reports. This situation is in the process of changing drastically. Technological change opened the door to a revolution in pricing when consumer financial transaction data came on-line and insurance scores using credit information became widely available and cheap. But the coming revolution in miles-based pricing may have an even bigger impact than the credit scoring revolution.

There are two key drivers of the change. First, analytical studies have confirmed that miles driven are hugely important for risk assessment. Second, technological change has given us the means to verify miles driven in relatively easy ways.

Auto insurance telematics is changing everything, but not in the way you might think. The current market share is still low. However, the data of cars equipped with telematic devices is already forcing change in the way we think about driving risk. Billions of road miles of precisely measured driving behavior are being analyzed by researchers around the world who are pouring millions of dollars and tens of thousands of hours into studying the statistical and actuarial implications of it all. The possibilities are staggering. Proprietary scoring methods may include how you corner left and right, how you accelerate and brake, the extent to which you exceed the speed limit, and even when you drive.

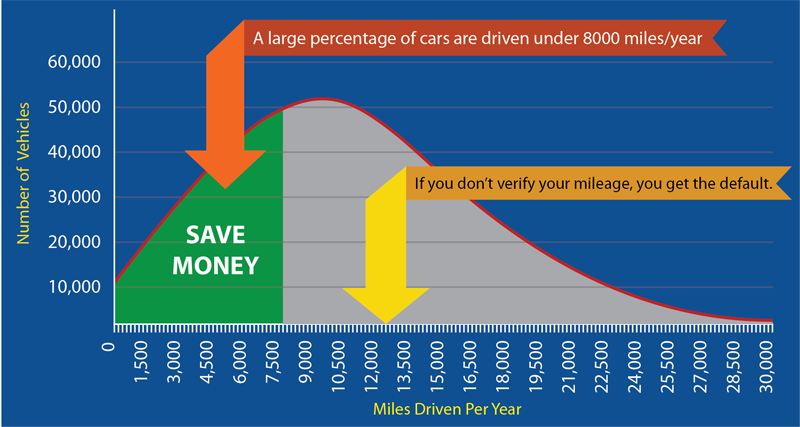

But the biggest single thing that has come out of this research so far is something very simple, and it confirms something we already suspected: Miles driven is hugely, hugely important for risk classification. It is becoming increasingly apparent that there are significant opportunities awaiting those who can find a way to improve measurement of mileage and move beyond the crude classification systems of yesteryear.

The key question then is how to get mileage you can use? History shows that unverified self-reporting is not likely to be the answer for the mass market, but a variety of possibilities is emerging for those interested in getting verifiable data. Telematics devices can be installed, but many people don’t want Big Brother riding shotgun. Fortunately, technological change has brought us relatively easy and noninvasive ways to get information on miles driven. Some methods use estimates based on data collected from past service and safety inspections. Another method is to leverage the ubiquity of smartphones with cameras and let each owner self-report verified odometer readings: With a simple snap-and-send, the vehicle owner can deliver an accurate picture of miles driven. The frequency and timeliness of data submissions can be aligned with a program of insurance.

A number of programs are already on the market, aimed at picking off the low mileage drivers and rewarding them with lower premiums. Thus, ignoring the revolution isn’t really a choice for agents or carriers. Those who don’t adapt will find themselves victimized—collateral damage of the ongoing push to measure risk more accurately. As we move into the future, fresh mileage data will be essential in getting real-time measurement of changes in driving risk.

(Posted in Property Casualty Insider: http://www.propertycasualtyinsider.com/revolutionary-times-in-auto-insurance-pricing/)

UBI Market Doubles, Reaches a Milestone

A recent report from Towers Watson shows that the world is making steady progress toward usage-based insurance (UBI). That steady growth is poised to become explosive if insurers can move faster and deal with privacy concerns while delivering UBI via smartphone apps that consume little of the battery’s charge. The report says market penetration has nearly doubled in less than a year and a half — reaching 8.5% of U.S. drivers in July, up from 4.5% in February 2013. UBI has reached a milestone, with all 50 states now having programs available. – Read more here.

A recent report from Towers Watson shows that the world is making steady progress toward usage-based insurance (UBI). That steady growth is poised to become explosive if insurers can move faster and deal with privacy concerns while delivering UBI via smartphone apps that consume little of the battery’s charge. The report says market penetration has nearly doubled in less than a year and a half — reaching 8.5% of U.S. drivers in July, up from 4.5% in February 2013. UBI has reached a milestone, with all 50 states now having programs available. – Read more here.

The $22 Billion of Auto Premiums That Will Disappear

Drivers will increasingly demand big discounts for low mileage. – Read more

Drivers will increasingly demand big discounts for low mileage. – Read more

Carriers Want Loyalty but Haven’t Earned It

Intermediaries will emerge that will shop automatically for insurance for customers on an hourly, daily or weekly basis. – Read more

Intermediaries will emerge that will shop automatically for insurance for customers on an hourly, daily or weekly basis. – Read more